Spencer R. Smith, KAUZ | Published on 10/9/2025

2025 Midterm Election Nonpartisan Voters Guide released

TEXAS (KAUZ)

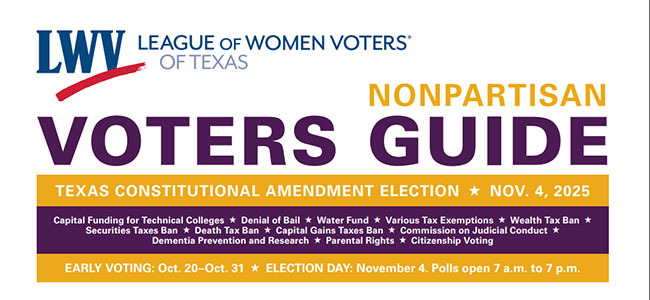

TEXAS (KAUZ) - The League of Women Voters (LWV) has released its

Nonpartisan Voters Guide, detailing the 17 proposed amendments to the Texas Constitution.

Videos explaining the propositions in detail can be viewed

here.

Early voting in Texas begins on October 20, and Election Day will be on November 4.

The following information is from the League of Women Voters, listing each of the 17 propositions, their ballot text, and a brief explanation:

Proposition 1

“The constitutional amendment providing for the creation of the permanent technical institution infrastructure fund and the available workforce education fund to support the capital needs of educational programs offered by the Texas State Technical College System.”

Proposition 1 Ballot Text

The Texas State Technical College (TSTC) System was established in 1965 to provide technical vocational education. It currently has 11 colleges across the state and offers two-year degrees and certificates in technical and vocational areas. 11,436 students attended Texas State Technical Colleges in 2023-2024.

If this proposed amendment were passed, it would use $52 million to create a permanent fund to support the TSTC. Earnings from this fund will be used for capital projects such as buying land, buildings and equipment to support the educational programs offered by these colleges.

The League of Women Voters Proposition 1 Explanation

Proposition 2

“The constitutional amendment prohibiting the imposition of a tax on the realized or unrealized capital gains of an individual, family, estate, or trust.”

Proposition 2 Ballot Text

When a capital asset (an investment such as stocks, bonds, and real estate) increases in value, the increase is considered a capital gain. Realized capital gains are the profits made when the investment is sold. Unrealized capital gains are the potential profit that could be made if that investment was sold at its then current market value, even though it is not sold.

Texas does not currently tax either realized capital gains or unrealized capital gains, and the recent Legislature did not propose any such tax.

The League of Women Voters Proposition 2 Explanation

Proposition 3

“The constitutional amendment requiring the denial of bail under certain circumstances to persons accused of certain offenses punishable as a felony.”

Proposition 3 Ballot Text

Currently, denying bail typically requires a full trial, which makes it very rare. Therefore, if a defendant has the money to post bond, they must be released even if there is evidence the person may commit future violent crimes.

This proposed amendment would expand the options available to officials setting bail, including the option to deny bail to ensure the safety of the community. This would apply to individuals accused of murder and similar violent offenses.

The League of Women Voters Proposition 3 Explanation

Proposition 4

“The constitutional amendment to dedicate a portion of the revenue derived from state sales and use taxes to the Texas water fund and to provide for the allocation and use of that revenue.”

Proposition 4 Ballot Text

The Texas Water Fund is a special fund created in 2023 and administered by the Texas Water Development Board to assist in financing water projects in Texas. This proposition would provide that in each fiscal year, the first $1 billion of sales tax revenue in excess of $46.5 billion would be allocated to the Texas Water Fund. This funding would continue through 2047, and would be used to address future water needs in Texas. The amount could be adjusted by the legislature with a two-thirds vote.

The League of Women Voters Proposition 4 Explanation

Proposition 5

“The constitutional amendment authorizing the legislature to exempt from ad valorem taxation tangible personal property consisting of animal feed held by the owner of theproperty for sale at retail.”

Proposition 5 Ballot Text

Under current law, animal feed is typically exempt from taxation at each location or transaction during its life cycle, from the field where it’s harvested to the purchase of the feed by a farmer or rancher, except for when the feed is sitting in a store as inventory.

This proposed amendment seeks to address this inconsistency by amending the Texas Constitution to authorize the Texas State Legislature to exempt animal feed held by an owner for retail sale from personal property taxes.

The League of Women Voters Proposition 5 Explanation

Proposition 6

“The constitutional amendment prohibiting the legislature from enacting a law imposing an occupation tax on certain entities that enter into transactions conveying securities or imposing a tax on certain securities transactions.”

Proposition 6 Ballot Text

Proposition 6 would amend the Texas Constitution by not allowing the state to tax securities transactions. Securities transactions are the buying and selling of financial assets such as stocks and bonds. Currently, no state levies taxes on securities transactions.

The League of Women Voters Proposition 6 Explanation

Proposition 7

“The constitutional amendment authorizing the legislature to provide for an exemption from ad valorem taxation of all or part of the market value of the residence homestead of the surviving spouse of a veteran who died as a result of a condition or disease that is presumed under federal law to have been service-connected.”

Proposition 7 Ballot Text

This proposition would allow the Legislature to provide a property tax exemption for spouses of veterans who died from a condition or disease related to their service.

This proposed amendment fixes a gap with respect to veterans who, while they do not qualify as fully disabled, died due to a condition or disease related to their service. These exemptions could be transferred to a subsequent property for an equal amount, but would apply only to a surviving spouse who had not remarried since the veteran’s death.

The League of Women Voters Proposition 7 Explanation

Proposition 8

“The constitutional amendment to prohibit the legislature from imposing death taxes applicable to a decedent’s property or the transfer of an estate, inheritance, legacy, succession, or gift.”

Proposition 8 Ballot Text

If passed, this amendment would prohibit the state of Texas from imposing a tax on the estate of a deceased person, commonly referred to as a “death tax”. The state would still be able to impose or change real estate title and motor vehicle transfer taxes, or normal property taxes.

The League of Women Voters Proposition 8 Explanation

Proposition 9

“The constitutional amendment to authorize the legislature to exempt from ad valorem taxation a portion of the market value of tangible personal property a person owns that is held or used for the production of income.”

Proposition 9 Ballot Text

Local taxing authorities, such as cities, counties, hospital districts, school districts and local college districts, tax personal property held or used for the production of income. This is a source of income used by these entities to pay for the services they provide to residents.

Business personal property that is held or used for the production of income includes inventory, computers, office furniture, manufacturing equipment, vehicles, machinery, and supplies. Th is does not include real estate. This tax is applied whether such personal property is owned or leased.

Currently $2,500 of business personal property is exempt from ad valorem taxation by local taxing entities. Th is proposed amendment would increase that exemption to $125,000 and would simplify the reporting requirements.

The League of Women Voters Proposition 9 Explanation

Proposition 10

“The constitutional amendment to authorize the legislature to provide for a temporary exemption from ad valorem taxation of the appraised value of an improvement to a residence homestead that is completely destroyed by a fire.”

Proposition 10 Ballot Text

If passed, this proposition would allow the legislature to pass a law that would exempt a home that has been destroyed by fire from property taxes for a period of time (to be determined by the legislature).

The League of Women Voters Proposition 10 Explanation

Proposition 11

“The constitutional amendment authorizing the legislature to increase the amount of the exemption from ad valorem taxation by a school district of the market value of the residence homestead of a person who is elderly or disabled.”

Proposition 11 Ballot Text

Th is proposed amendment would authorize the state legislature to increase the property tax homestead exemption for persons who are age 65 or older or who have disabilities from the current $10,000 to $60,000. This amount is in addition to the regular homestead exemption.

In addition, the legislature plans to appropriate funds to reimburse impacted school districts. The additional tax exemption would take effect for the tax year that began January 1, 2025.

The League of Women Voters Proposition 11 Explanation

Proposition 12

“The constitutional amendment regarding the membership of the State Commission on Judicial Conduct, the membership of the tribunal to review the commission’s recommendations, and the authority of the commission, the tribunal, and the Texas Supreme Court to more effectively sanction judges and justices for judicial misconduct.”

Proposition 12 Ballot Text

The State Commission on Judicial Conduct (SCJC) is a Texas state agency that investigates judicial misconduct and disability.This proposed amendment addresses who selects the members in the following ways:

The number of appointees by the governor Increases from five to seven;

The number of appointees by the Texas Bar decreases from two to zero; and

The number of appointees by the Supreme Court will remain at six.

All the above will be subject to the advice and consent of the Texas Senate.

The minimum age of appointees will increase from 30 to 35.

All seven judges who make up the Review Tribunal (responsible for reviewing the actions of the SCJC), will be appointed by the Texas Supreme Court Chief Justice.

Currently the Review Tribunal judges are selected by various judges of the Texas Courts of Appeals.

This proposition would also make changes necessary to implement various reforms of Texas courts and to increase the base pay of district and other judges.

The League of Women Voters Proposition 12 Explanation

Proposition 13

“The constitutional amendment to increase the amount of the exemption of residence homesteads from ad valorem taxation by a school district from $100,000 to $140,000.”

Proposition 13 Ballot Text

A homestead exemption is the amount of the appraised value of a primary residence that is not subject to taxes by a local school district. Property taxes are typically calculated using the appraised value minus the exemption amount, thereby lowering a homeowner’s overall taxes.

If passed, this amendment would increase the current homestead tax exemption from $100,000 to $140,000. The law related to this proposed amendment requires that the state reimburse school districts for revenues lost due to this higher exemption amount.

The League of Women Voters Proposition 13 Explanation

Proposition 14

“The constitutional amendment providing for the establishment of the Dementia Prevention and Research Institute of Texas, establishing the Dementia Prevention and Research Fund to provide money for research on and prevention and treatment of dementia, Alzheimer’s disease, Parkinson’s disease, and related disorders in this state, and transferring to that fund $3 billion from state general revenue.”

Proposition 14 Ballot Text

Th is amendment proposes establishing a Dementia Prevention Research Institute (DPRIT). The goal of DPRIT is to accelerate research that leads to breakthroughs in the prevention and treatment of dementia and related disorders.

DPRIT would be created with an initial $3 billion investment that is anticipated to last at least 10 years. Up to $300 million could be spent each year on research grants, facilities and operations. The fund will consist of money from the Legislature, investment income, grants, and gifts. Safeguards would be in place to ensure the grant money is awarded based on merit and is used properly.

The League of Women Voters Proposition 14 Explanation

Proposition 15

“The constitutional amendment affirming that parents are the primary decision makers for their children.”

Proposition 15 Ballot Text

Parents have constitutional rights to make decisions for their children based on federal case laws. Because laws can change over time, including the rights of parents, the Texas Constitution would permanently establish the right of parents to raise and educate their children.

The League of Women Voters Proposition 15 Explanation

Proposition 16

“The constitutional amendment clarifying that a voter must be a United States citizen.”

Proposition 16 Ballot Text

The Texas Constitution does not explicitly state that non-citizens cannot vote in state or local elections. However, to vote in state and local elections you must be registered to vote and to register you must be a citizen.

The League of Women Voters Proposition 16 Explanation

Proposition 17

“The constitutional amendment to authorize the legislature to provide for an exemption from ad valorem taxation of the amount of the market value of real property located in a county that borders the United Mexican States that arises from the installation or construction on the property of border security infrastructure and related improvements.”

Proposition 17 Ballot Text

Currently, Texas makes a one- time payment to property owners that voluntarily sign an easement contract to host the border wall. There is no tax exemption available to property owners for the assessed value of the property for border security infrastructure. The resolution would authorize the Legislature to define “border security infrastructure” and define additional eligibility requirements for the exemption. The resolution will only apply in counties along the Texas-Mexico border.

The League of Women Voters Proposition 17 Explanation

Copyright 2025 KAUZ. All rights reserved.

Read more...